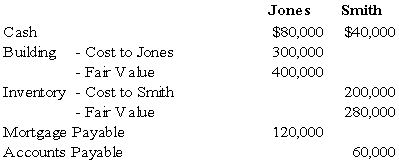

Jones and Smith formed a partnership with each partner contributing the following items:

Assume that for tax purposes Jones and Smith agree to share equally in the liabilities assumed by the Jones and Smith partnership.

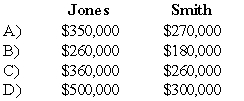

-Refer to the above information.What is the balance in each partner's capital account for financial accounting purposes?

Definitions:

Inverted Pyramid Style

A writing style commonly used in news reporting and journalism where the most important information is presented first, followed by details in decreasing order of importance.

Important Information

Data or facts that are crucial or essential to understand a topic, make decisions, or solve problems.

Indirect Approach

A communication strategy where the main point or request is not presented directly at the beginning but is instead gradually introduced.

Mobile Device

A portable computing device such as a smartphone or tablet that allows for voice and data communication over a network.

Q10: Based on the preceding information,what is the

Q15: Based on the preceding information,the consolidating entry

Q29: Based on the information given above,what was

Q51: Reporting requirements of other not-for-profit entities (ONPOs)are

Q55: Based on the preceding information,by what amount

Q60: Based on the preceding information,the entries on

Q63: The JKL partnership liquidated its business in

Q64: If the functional currency is the local

Q64: Based on the preceding information,which of the

Q71: Works of art and historical treasures purchased