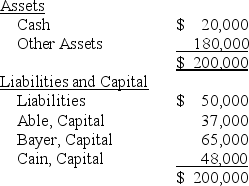

The following balance sheet is for the partnership of Able,Bayer,and Cain which shares profits and losses in the ratio of 4:4:2,respectively.

The original partnership was dissolved when its assets,liabilities,and capital were as shown on the above balance sheet and liquidated by selling assets in installments.The first sale of noncash assets having a book value of $90,000 realized $50,000,and all cash available after settlement with creditors was distributed.How much cash should the respective partners receive (to the nearest dollar) ?

Definitions:

Corrective Taxes

Taxes implemented to correct the market outcomes that are not efficient by internalizing external costs, often used in environmental policy to address pollution.

Regulations

Standards and rules formulated by governmental or nongovernmental organizations to govern conduct within certain spheres of activity.

Pollution Permits

Marketable permits allowing holders to emit a certain amount of pollution, used as a regulatory tool to control environmental impacts.

Corrective Tax

A tax designed to induce private decision-makers to take account of the social costs that arise from a negative externality.

Q9: A private university offers graduate assistantships to

Q15: Which of the following classes of information

Q15: All of the following describe the International

Q31: Which of the following items are important

Q33: A subsidiary issues bonds.The parent can then

Q36: Based on the information given above,what amount

Q45: During the fiscal year ended June 30,20X9,Global

Q63: The JKL partnership liquidated its business in

Q65: Based on the preceding information,the translation of

Q72: How would a company report a change