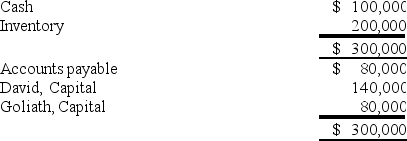

Partners David and Goliath have decided to liquidate their business.The following information is available:

David and Goliath share profits and losses in a 3:1 ratio,respectively.During the first month of liquidation,half the inventory is sold for $70,000,and $50,000 of the accounts payable are paid.During the second month,the rest of the inventory is sold for $55,000,and the remaining accounts payable are paid.Cash is distributed at the end of each month,and the liquidation is completed at the end of the second month.

David and Goliath share profits and losses in a 3:1 ratio,respectively.During the first month of liquidation,half the inventory is sold for $70,000,and $50,000 of the accounts payable are paid.During the second month,the rest of the inventory is sold for $55,000,and the remaining accounts payable are paid.Cash is distributed at the end of each month,and the liquidation is completed at the end of the second month.

-Refer to the information provided above.How much cash will be distributed to David at the end of the second month?

Definitions:

Q6: Based on the preceding information,on the statement

Q19: Detroit based Auto Corporation,purchased ancillaries from a

Q28: Based on the information given above,the indirect

Q32: Refer to Exhibit 1.7. Calculate your holding

Q43: Refer to the information provided above.Allen and

Q65: GASB 34 established four types of interfund

Q74: A debt service fund of Clifton received

Q75: Tuttle Company discloses supplementary operating segment information

Q93: Transaction: Endowment income was earned.The donor placed

Q116: Incurred fund-raising costs.<br>A)Increases unestricted net assets.<br>B)Decreases unrestricted