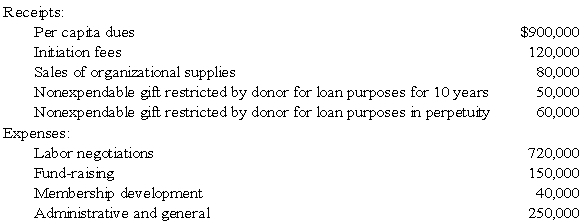

Golden Path, a labor union, had the following receipts and expenses for the year ended

December 31, 20X8:

The union's constitution provides that 12 percent of the per capita dues be designated for the strike insurance fund to be distributed for strike relief at the discretion of the union's executive board.

-Based on the information provided,in Golden Path's statement of activities for the year ended December 31,20X8,what amount should be reported under the classification of revenue from unrestricted funds?

Definitions:

Social Security

Social Security is a government program designed to provide financial support to retirees, disabled individuals, and survivors of deceased workers, funded through payroll taxes.

Medicare

Medicare is a federal health insurance program in the United States for people aged 65 and older, as well as for some younger people with disabilities.

Federal Withholding

Taxes that an employer withholds from an employee's salary or wages, paid directly to the government as prepayment of the employee's tax liability.

Sales Salaries

Expenses associated with paying the salaries of sales personnel, typically classified under operating expenses in the income statement.

Q11: Based on the information given above,what amount

Q20: What is the general form of the

Q22: The Board of Commissioners of Vane City

Q28: Based on the information given above,what amount

Q35: Adding foreign stocks and bonds to a

Q38: When a partner retires from a partnership

Q44: Based on the preceding information,what is the

Q52: Adding Japanese, Australian, and Italian stocks to

Q59: Refer to Exhibit 1.3. What was your

Q66: Refer to the information provided above.Erin directly