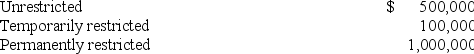

Local Services,a voluntary health and welfare organization had the following classes of net assets on July 1,20X8,the beginning of its fiscal year:

During the year ended June 30,20X9,the following events occurred:

During the year ended June 30,20X9,the following events occurred:

(1) It purchased equipment,costing $100,000,with contributions restricted for this purpose.The contributions had been received from donors during June of 20X8.

(2) It received $130,000 of cash donations which were restricted for research activities.During the year ended June 30,20X9,$90,000 of the contributions were expended on research.

(3) It sold investments classified in the net assets with donor restrictions class for a loss of $40,000.Dividends and interest income earned on the investments amounted to $70,000.There were no restrictions on how investment income was to be used.

(4) It received cash contributions of $200,000 from donors who did not place either time or use restrictions upon their donations.

(5) Expenses,excluding depreciation expense,for program services and supporting services incurred during the year ended June 30,20X9,amounted to $260,000.

(6) Depreciation expense for the year ended June 30,20X9,was $80,000.

-Refer to the above information.On the statement of activities for the year ended June 30,20X9,reclassifications would be reported at:

Definitions:

Penicillin

An antibiotic drug derived from certain types of molds, used to treat bacterial infections by inhibiting the growth of bacteria.

Clostridium Difficile

A bacterium that can cause symptoms ranging from diarrhea to life-threatening inflammation of the colon, often related to antibiotic use.

Antibacterial Soap

Soap containing chemical ingredients specifically intended to kill or inhibit the growth of bacteria.

Hand Sanitizer

A liquid or gel, often alcohol-based, used to reduce infectious agents on the hands, providing a cleaning effect without the need for water.

Q4: Based on the information given above,what amount

Q6: Refer to the information given above.What amount

Q7: Refer to the information given above.What amount

Q16: Refer to the above information.On the internal

Q16: A partnership is a(n):<br>I.accounting entity.<br>II.taxable entity.<br>A) I

Q21: Tests have shown that if small filters

Q29: A pure auction market is one in

Q34: ASC 270 uses which view of interim

Q71: The asset allocation decision must involve a

Q154: Technical analysis and the efficient market hypothesis