On January 1,20X7,Gild Company acquired 60 percent of the outstanding common stock of Leeds Company at the book value of the shares acquired.On that date,the fair value of noncontrolling interest was equal to 40 percent of book value of Leeds.At the time of purchase,Leeds had common stock of $1,000,000 outstanding and retained earnings of $800,000.

On December 31,20X7,Gild purchased 50 percent of Leeds' bonds outstanding which were originally issued on January 2,20X4,at 99.The total bond issue has a face value of $600,000,pays 10 percent interest annually,and has a 10-year maturity.Any premium or discount is amortized on a straight-line basis.Gild paid $306,000 for its investment in Leeds' bonds and intends to hold the bonds until maturity.

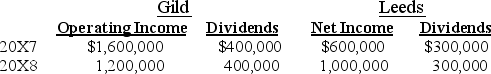

Income and dividends for Gild and Leeds for 20X7 and 20X8 are as follows:

Assume Gild accounts for its investment in Leeds stock using the fully adjusted equity method.

Required:

A)Present the worksheet consolidation entries necessary to prepare consolidated financial statements for 20X7.

B)Present the worksheet consolidation entries necessary to prepare consolidated financial statements for 20X8.

Problem 38 (continued):

Definitions:

Emotional Investment

A commitment of one's feelings and emotional energy to a project, person, or idea.

Direct Approach

A straightforward method of communication where the main point is presented at the beginning of the message.

Negative News

Information or reports that convey unfavorable, adverse, or undesirable outcomes or situations.

Routine

A set of habitual or fixed procedures and practices, typically followed to accomplish tasks or maintain productivity.

Q2: Refer to Exhibit 1A.1. The standard deviation

Q7: A reorganization value in excess of amounts

Q10: Secondary equity issues are new shares offered

Q10: At June 30,20X9,total assets for the various

Q11: Refer to Exhibit 4.2. Calculate a value

Q30: "Basis for measuring contributions" describes which term

Q39: What account should be debited in the

Q63: On July 1,20X8,Cleveland established a capital projects

Q63: What would the after-tax yield be on

Q89: Refer to Exhibit 4.5. Calculate the price