On January 1,20X7,Gild Company acquired 60 percent of the outstanding common stock of Leeds Company at the book value of the shares acquired.On that date,the fair value of noncontrolling interest was equal to 40 percent of book value of Leeds.At the time of purchase,Leeds had common stock of $1,000,000 outstanding and retained earnings of $800,000.

On December 31,20X7,Gild purchased 50 percent of Leeds' bonds outstanding which were originally issued on January 2,20X4,at 99.The total bond issue has a face value of $600,000,pays 10 percent interest annually,and has a 10-year maturity.Any premium or discount is amortized on a straight-line basis.Gild paid $306,000 for its investment in Leeds' bonds and intends to hold the bonds until maturity.

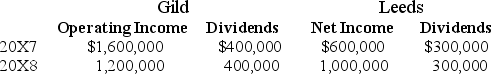

Income and dividends for Gild and Leeds for 20X7 and 20X8 are as follows:

Assume Gild accounts for its investment in Leeds stock using the cost method.

Required:

A)Present the worksheet consolidation entries necessary to prepare consolidated financial statements for 20X7.

B)Present the worksheet consolidation entries necessary to prepare consolidated financial statements for 20X8.

Problem 40 (continued):

Definitions:

Optimal Strategy

Strategy that maximizes a player’s expected payoff.

Auctioned

A method of sale where goods or services are sold to the highest bidder.

Highest Bidder

The individual or party that offers the most money for an item in an auction or competitive bidding situation.

Consumer Surplus

Difference between what a consumer is willing to pay for a good and the amount actually paid.

Q3: Based on the information given above,in the

Q26: The PQ partnership has the following plan

Q27: On January 1,20X7,Gild Company acquired 60 percent

Q38: Creditors may file which type of petition

Q39: Based on the information given above,if 20X9

Q42: Assume that you invest $750 at the

Q43: Which index is created by first deriving

Q45: Confirmation bias refers to the situation in

Q47: Refer to Exhibit 4.7. If the December

Q146: According to technical analysts, which mutual fund