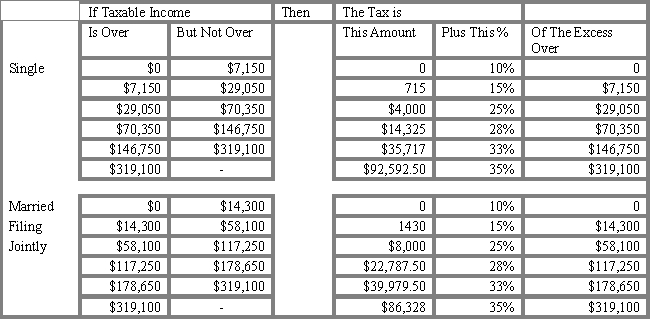

USE THE TAX TABLE PROVIDED BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 2.1. What is the tax liability for a single individual with taxable income of $85,000?

Definitions:

Qualified Opinion

An auditor's opinion suggesting that the financial statements of a firm are fairly presented, except for a particular area or exception.

Adverse Opinion

An auditor's statement indicating that a company's financial statements are not presented fairly or in conformity with Generally Accepted Accounting Principles (GAAP).

Common Expenses

Recurring costs that are shared among entities within a business, typically for maintenance and administrative services.

Operating Profit

The profit earned from a firm's core business operations, excluding deductions of interest and taxes.

Q3: According to ASC 958,the statement of financial

Q5: Which of the following is NOT a

Q5: "Tangible fixed assets not depreciated by a

Q10: The total risk for a security can

Q23: Based on the preceding information,what is the

Q39: Refer to Exhibit 3.7. At the end

Q53: Refer to Exhibit 4.2. Calculate a price

Q60: The U.S. secondary market with the largest

Q77: The purpose of calculating the covariance between

Q129: Refer to Exhibit 5.2. What is the