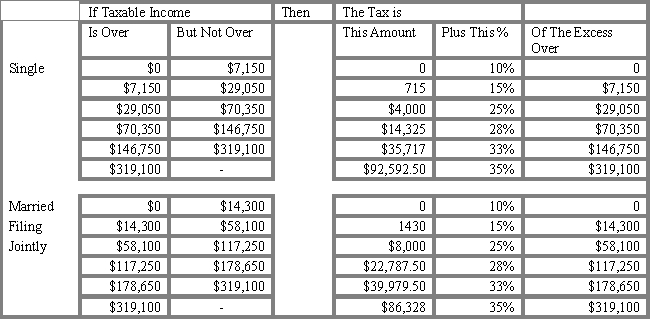

USE THE TAX TABLE PROVIDED BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 2.1. What is the tax liability for a married couple filing jointly with taxable income of $125,000?

Definitions:

Conceptual

Pertaining to concepts or ideas; involving the use of the mind to understand, categorize, or define something.

Intellectual

Relating to the intellect or involving the ability to think and understand at a high level of complexity.

Reciprocal

Characterized by mutual exchange or influence, in which actions or emotions are mirrored or returned by others.

Self-locomotion

The capacity of an individual to move independently, often referring to the developmental stage in infants.

Q3: Which of the following is NOT a

Q7: 16.99%What is the expected return of the

Q9: A private university offers graduate assistantships to

Q12: Refer to Exhibit 3.1. How many shares

Q21: Based on the information given above,what amount

Q34: Risk is defined as the uncertainty of

Q46: A block trade is one which involves

Q61: The variance of expected returns is equal

Q93: The random walk hypothesis contends that stock

Q150: Based on the daily closings for the