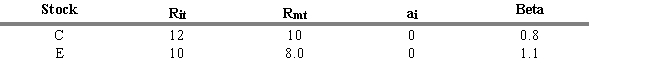

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Rit = return for stock i during period t

Rit = return for stock i during period t

Rmt = return for the aggregate market during period t

-Refer to Exhibit 5.1. What is the abnormal rate of return for Stock E during period t using only the aggregate market return (ignore differential systematic risk) ?

Definitions:

Bayes' Theorem

A mathematical formula that describes how to update the probabilities of hypotheses when given evidence.

Multiplication Law

A probability rule that determines the likelihood of two independent events occurring together by multiplying their individual probabilities.

Chebyshev's Theorem

A statistical theorem stating that for any set of data, the proportion of results that fall within k standard deviations from the mean is at least 1-1/k^2 for k>1.

Empirical Rule

A rule that can be used to compute the percentage of data values that must be within one, two, and three standard deviations of the mean for data that exhibit a bell-shaped distribution.

Q1: Based on the information given above,what amount

Q17: Research has shown that the asset allocation

Q25: Received pledges from donors who placed no

Q33: A subsidiary issues bonds.The parent can then

Q33: Semivariance, when applied to portfolio theory, is

Q41: Refer to Exhibit 4.7. If the December

Q48: John is 55 years old and has

Q69: CAPM states that only the overall market

Q73: You purchased 100 shares of Highlight Company

Q114: Refer to Exhibit 6.16. What is the