USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

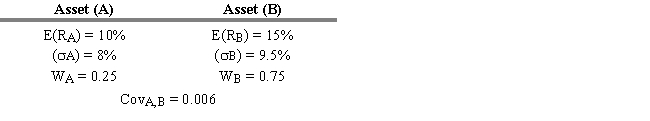

I), Covariance (COVi,j), and Asset Weight (Wi) Are as Shown

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 6.1. What is the expected return of a portfolio of two risky assets if the expected return E(Ri) , standard deviation ( i) , covariance (COVi,j) , and asset weight (Wi) are as shown above?

Definitions:

Q1: Refer to Exhibit 1.8. Compute the arithmetic

Q11: Refer to Exhibit 1.8. Compute the standard

Q28: Which of the following is correct?<br>A) if

Q40: Refer to Exhibit 1.6. Calculate the HPY

Q50: The dividend payout ratio for the aggregate

Q80: In a multifactor model, confidence risk represents<br>A)

Q114: If interest rates rise due to inflation,

Q126: Coincident indicators include economic time series that

Q126: Assume the risk-free rate is 4.5 percent

Q184: An overvalued stock is a non-growth stock.