USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

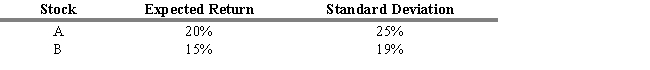

Stocks A and B have a correlation coefficient of -0.8. The stocks' expected returns and standard deviations are in the table below. A portfolio consisting of 40% of stock A and 60% of stock B is constructed.

-Refer to Exhibit 6.14. What is the expected return of the stock A and B portfolio?

Definitions:

Demand Conditions

Demand conditions refer to the various factors that affect consumer desire for products or services, including price, income levels, and preferences.

Supply Conditions

Factors that affect a producer's ability and willingness to offer goods or services for sale, including costs, technology, and regulatory environment.

Central Planning

Central planning refers to an economic system where the government or central authority makes all decisions regarding the production and distribution of goods and services.

Political Incentives

Motives that drive politicians to make decisions or enact policies, often based on the pursuit of power, reelection, or adherence to ideological beliefs.

Q7: _ gains are taxable and occur when

Q16: Refer to Exhibit 3.7. At the end

Q20: Refer to Exhibit 3.2. If the maintenance

Q22: Management may "under-reserve" in order to meet

Q42: A growth company can invest in projects

Q48: Refer to Exhibit 9.15. Calculate the dollar

Q74: Assume that as a portfolio manager the

Q86: To take advantage of long-run price movements

Q135: Refer to Exhibit 7.1. If you expected

Q138: The Dow Theory contends that stock price