USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

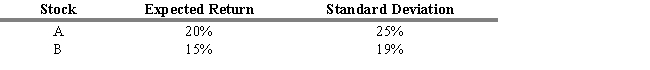

Stocks A and B have a correlation coefficient of -0.8. The stocks' expected returns and standard deviations are in the table below. A portfolio consisting of 40% of stock A and 60% of stock B is constructed.

-Refer to Exhibit 6.14. What is the standard deviation of the stock A and B portfolio?

Definitions:

Development Cost

The total expenses incurred in the development of a new product, service, or system, including research, design, testing, and materials.

Geographically Dispersed

Refers to teams, operations, or individuals spread out across multiple physical locations.

Learning Styles

The preferred ways or methods through which individuals learn best, such as visual, auditory, or kinesthetic learning.

Customized Training

Training programs specifically designed to meet the unique needs and objectives of a particular organization or group of individuals.

Q2: Refer to Exhibit 3.4. What is your

Q7: Two major classes of technicians include the

Q28: CML and SML measure total risk by

Q32: Refer to Exhibit 4.2. What is the

Q53: Refer to Exhibit 9.12. Determine the P/E

Q59: Tests of the efficient market hypothesis (EMH)

Q84: Call markets can also be used at

Q87: The APT assumes that security returns are

Q115: Under the following conditions, what are the

Q183: The cyclical indicator approach to market analysis