USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

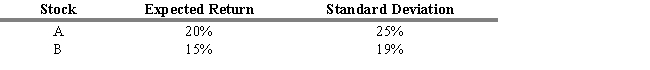

Stocks A and B have a correlation coefficient of -0.8. The stocks' expected returns and standard deviations are in the table below. A portfolio consisting of 40% of stock A and 60% of stock B is constructed.

-Refer to Exhibit 6.14. What percentage of stock A should be invested to obtain the minimum risk portfolio that contains stock A and B?

Definitions:

Q3: A company goes public for many reasons,

Q22: Once the portfolio is constructed, it must

Q23: The majority of technicians follow many trading

Q30: Between 1980 and 1990, the standard deviation

Q42: A growth company can invest in projects

Q69: Those who employ the bottom-up approach start

Q72: Within a specific market, the top-down analyst

Q93: If, for the S&P Industrials Index, the

Q95: When a firm seeks to identify itself

Q112: Results of studies concerning corporate insider trading