USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

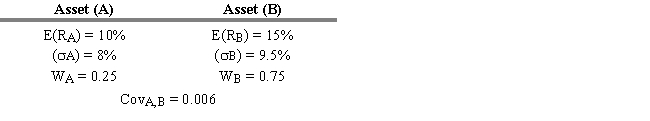

I), Covariance (COVi,j), and Asset Weight (Wi) Are as Shown

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 6.1. What is the expected return of a portfolio of two risky assets if the expected return E(Ri) , standard deviation ( i) , covariance (COVi,j) , and asset weight (Wi) are as shown above?

Definitions:

Absorption Cost

A method of product costing that includes all manufacturing costs - direct materials, direct labor, and both variable and fixed overhead.

Mark-Up Percentage

Mark-up percentage is the ratio between the cost of a good or service and its selling price, expressed as a percentage over the cost, indicating the profit margin.

Return On Investment

A measure used to evaluate the efficiency or profitability of an investment compared to its initial cost.

Cost-Plus Pricing

A pricing approach that involves adding a consistent percentage or fixed sum to the production cost of a product or service to set its sale price.

Q7: In a continuous market, trades occur at

Q30: Refer to Exhibit 1.9. Calculate the risk

Q41: Refer to Exhibit 3.4. What is your

Q46: A block trade is one which involves

Q48: The APT does not require a market

Q57: As the correlation coefficient between two assets

Q62: Refer to Exhibit 3.7. At the end

Q76: Rule 144A reduced registration documentation requirements for

Q95: Refer to Exhibit 7.1. Compute the beta

Q144: In well developed economies, markets are not