USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

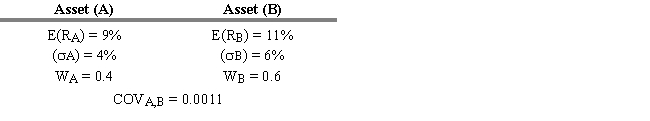

I), Covariance (COVi,j), and Asset Weight (Wi) Are as Shown

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 6.3. What is the expected return of a portfolio of two risky assets if the expected return E(Ri) , standard deviation ( i) , covariance (COVi,j) , and asset weight (Wi) are as shown above?

Definitions:

Carrying Amount

The value at which an asset is recognized on the balance sheet, calculated as the original cost minus accumulated depreciation and impairment losses.

Straight-Line Method

A depreciation method that allocates the cost of a fixed asset evenly over its useful life.

Straight-Line Method

A rephrased definition: A method for calculating depreciation by dividing the difference between an asset's cost and its salvage value by the number of years it is expected to be used.

Amortization

The gradual reduction of the cost or value of an intangible asset over its useful life.

Q15: You are given a two-asset portfolio with

Q21: Under the following conditions, what are the

Q23: For an investor with a time horizon

Q43: Which of the following is NOT a

Q46: Refer to Exhibit 5.1. What is the

Q52: Underpriced stocks can be ranked using the

Q71: An example of a relative valuation technique

Q108: Given Gilbert's beta of 1.10 and a

Q134: Refer to Exhibit 5.4. What is the

Q142: Technicians using the confidence index published by