USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

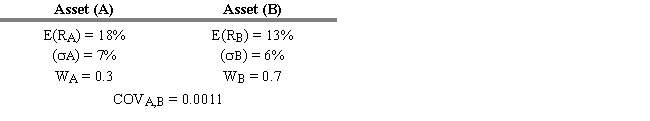

I), Covariance (COVi,j), and Asset Weight (Wi) Are as Shown

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 6.9. What is the expected return of a portfolio of two risky assets if the expected return E(Ri) , standard deviation ( i) , covariance (COVi,j) , and asset weight (Wi) are as shown above?

Definitions:

Media

Various platforms for communication, including television, radio, newspapers, and the internet, used to store and deliver information or data.

Long-Distance

Relates to situations, communications, or transportation covering large areas or extending over miles.

Self-Expansion

A psychological model suggesting individuals have a fundamental motivation to enhance their efficacy through relationships and experiences, leading to self-growth.

Romantic Relationships

Emotional and physical bonds between two individuals that typically involve love, attraction, and commitment.

Q21: Operating margins are defined as<br>A) Gross Profit/Sales.<br>B)

Q36: Consider the following two factor APT

Q37: The index of leading indicators includes all

Q51: Refer to Exhibit 6.7. What is the

Q61: Refer to Exhibit 9.3. What is your

Q66: The real risk-free rate depends on the

Q69: An individual in the 36 percent tax

Q72: Investigators have tested the strong form EMH

Q106: A portfolio manager is considering adding another

Q212: Refer to Exhibit 9.5. Calculate the P/E