USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

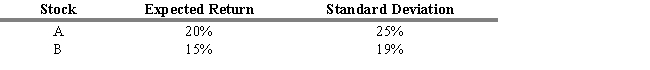

Stocks A and B have a correlation coefficient of -0.8. The stocks' expected returns and standard deviations are in the table below. A portfolio consisting of 40% of stock A and 60% of stock B is constructed.

-Refer to Exhibit 6.14. What is the expected return of the stock A and B portfolio?

Definitions:

Levels

Different values or categories that a variable can take, often used in the context of categorical variables in research.

dfWG

Degrees of freedom within groups, a term used in statistical analysis, particularly ANOVA, to indicate the number of independent pieces of information available to estimate variances within the groups.

Degrees of Freedom

A concept in statistics that refers to the number of values in a calculation that are free to vary without violating the constraints of the calculation.

Levels Minus One

In analysis of variance (ANOVA), it refers to the number of levels in a factor minus one, which dictates the number of comparisons that can be made.

Q5: An individual investor's utility curves specify the

Q9: A "runs test" on successive stock price

Q10: A company has a dividend payout ratio

Q24: Refer to Exhibit 6.4. What is

Q26: Refer to Exhibit 4.3. Calculate the average

Q34: The security market line (SML) graphs the

Q70: The two components that are required in

Q71: Findings by Basu that stocks with high

Q82: The prospect theory contends that utility depends

Q114: Some studies have attempted to determine whether