USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

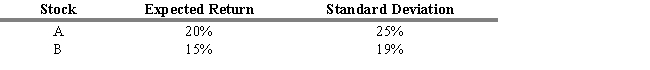

Stocks A and B have a correlation coefficient of -0.8. The stocks' expected returns and standard deviations are in the table below. A portfolio consisting of 40% of stock A and 60% of stock B is constructed.

-Refer to Exhibit 6.14. What is the standard deviation of the stock A and B portfolio?

Definitions:

Two-tail

A term used in statistical tests where the critical region is split between both ends of the distribution, testing for either significantly greater or lesser outcomes than the expected value.

Kruskal-Wallis Test

A non-parametric method for testing whether samples originate from the same distribution, often used as an alternative to one-way ANOVA when the assumptions of ANOVA are not met.

ANOVA F Test

A statistical test used to determine if there are any statistically significant differences between the means of three or more independent groups.

Completely Randomized Experiments

Experimental designs where all subjects are allocated to groups based only on chance, reducing systematic bias.

Q8: Refer to Exhibit 4.5. Calculate the percentage

Q16: Refer to Exhibit 3.7. At the end

Q26: A trading rule which signals purchase of

Q50: Refer to Exhibit 7.6. How does Jonathan

Q52: Underpriced stocks can be ranked using the

Q57: The correlations among the U.S. investment-grade-bond series

Q100: An offensive competitive strategy involves positioning the

Q113: According to the APT model, all securities

Q126: Assume the risk-free rate is 4.5 percent

Q134: Refer to Exhibit 5.4. What is the