USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

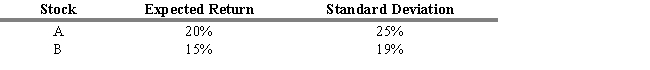

Stocks A and B have a correlation coefficient of -0.8. The stocks' expected returns and standard deviations are in the table below. A portfolio consisting of 40% of stock A and 60% of stock B is constructed.

-Refer to Exhibit 6.14. What percentage of stock A should be invested to obtain the minimum risk portfolio that contains stock A and B?

Definitions:

Salaries Payable

A liability account that records the amount of salaries owed to employees but not yet paid.

Accrued

Income earned or expenses incurred before cash has been exchanged, often recognized in the accounting process.

Insurance Policy

A legal contract between an insurer and the insured, outlining the terms, coverages, premiums, and conditions under which the insurer agrees to compensate the insured.

Adjusting Entry

A journal entry made at the end of an accounting period to allocate revenues and expenses to the period in which they actually occurred.

Q10: Which of the following is not a

Q12: Refer to Exhibit 3.1. How many shares

Q19: Hunter Corporation had a dividend payout ratio

Q27: Refer to Exhibit 6.7. What is

Q56: Assume that as a portfolio manager the

Q68: A good secondary market is important to

Q78: Net margins are defined as<br>A) Gross Profit/Sales.<br>B)

Q79: _ charts show time series of price,

Q148: Refer to Exhibit 9.6. Estimate the firm's

Q200: Refer to Exhibit 9.16. Calculate the sustainable