USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

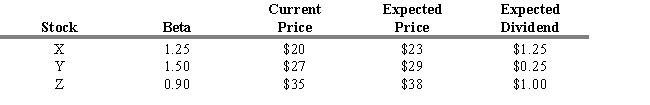

You expect the risk-free rate (RFR) to be 3 percent and the market return to be 8 percent. You also have the following information about three stocks.

-Refer to Exhibit 7.2. What are the expected (required) rates of return for the three stocks (in the order X, Y, Z) ?

Definitions:

Economic Profits

The difference between a firm's total revenue and its total expenses, including both explicit and implicit costs.

Product Price

The amount of money required to purchase a specific product or service.

Production Capacity

The maximum output that a business can produce in a given period under normal conditions.

Consumers' Desire

The inclination or preference of consumers towards certain goods, services, or experiences.

Q21: Tests have shown that if small filters

Q23: Calculate the expected return for a three-asset

Q45: An aggregate market index can be used

Q60: A stock pitch includes all of the

Q71: Contrary trading rules assert that investors tend

Q72: Within a specific market, the top-down analyst

Q74: Refer to Exhibit 6.8. What is

Q79: What is the implied growth duration of

Q91: Which of the following statements about the

Q112: Refer to Exhibit 7.2. What is your