USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

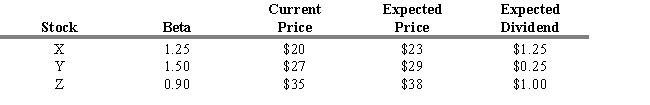

You expect the risk-free rate (RFR) to be 3 percent and the market return to be 8 percent. You also have the following information about three stocks.

-Refer to Exhibit 7.2. What are the estimated rates of return for the three stocks (in the order X, Y, Z) ?

Definitions:

Random Assignment

A technique for assigning individuals to different groups in an experiment using randomization, to ensure that every participant has an equal chance of being placed in any group.

Cause-effect Inferences

Logical deductions that suggest a relationship where one event (the cause) leads to the occurrence of another event (the effect).

External Validity

The extent to which research findings can be generalized to settings or groups outside the study.

Confounding Variables

External factors that can influence both the dependent and independent variables, potentially biasing the results of a study.

Q11: Refer to Exhibit 4.2. Calculate a value

Q30: Fund XYZ had a pretax return of

Q53: The expected return for Zbrite stock calculated

Q71: The sustainable growth rate can be calculated

Q74: All of the following are characteristics of

Q83: Under the following conditions, what are the

Q103: Refer to Exhibit 7.3. The covariance between

Q134: Calculate the expected return for A Industries,

Q145: The implication of efficient capital markets and

Q163: What is the implied growth duration of