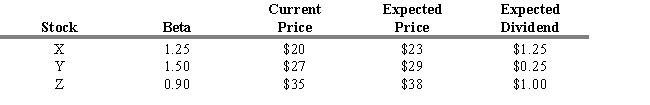

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

You expect the risk-free rate (RFR) to be 3 percent and the market return to be 8 percent. You also have the following information about three stocks.

-Refer to Exhibit 7.2. What is your investment strategy concerning the three stocks?

Definitions:

Earnings Per Share

Earnings per share (EPS) is a financial metric that divides a company's profit by the number of its outstanding shares, indicating the company's profitability on a per-share basis.

Efficient Market

A market hypothesis that posits that asset prices fully reflect all available information, making it impossible to consistently achieve higher returns.

Investor Expectations

The assumptions or beliefs about future economic and financial market conditions that influence investment decisions.

Market Value

The cost at which a property would be sold in a competitive bidding environment.

Q10: Which of the following is not a

Q61: Studies have shown that a well-diversified investor

Q76: Recent studies indicate that due to lower

Q78: Refer to Exhibit 3.6. Suppose at the

Q83: The Value Line Composite Average is calculated

Q159: Refer to Exhibit 5.2. What is the

Q163: What is the implied growth duration of

Q166: Refer to Exhibit 9.5. The firm's sustainable

Q174: Refer to Exhibit 9.11. Determine the P/E

Q198: Earnings growth and dividend yield will be