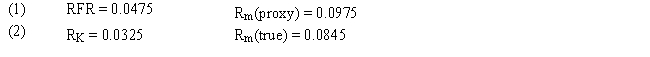

Assume that as a portfolio manager the beta of your portfolio is 0.85 and that your performance is exactly on target with the SML data under condition 1. If the true SML data is given by condition 2, how much does your performance differ from the true SML?

Definitions:

Total Return

The overall financial gain or loss on an investment, considering both capital gains and income such as interest or dividends.

Dividend

A portion of a company's earnings that is paid to shareholders, usually on a regular basis.

Nominal Rate

The officially declared or promoted rate of interest for a loan or investment, excluding the effects of compounding or any associated fees.

Loan

A borrowed sum of money that is expected to be paid back with interest.

Q9: Refer to Exhibit 4.5. Calculate the price

Q11: According to the dividend growth model, if

Q29: Which of the following is NOTa relaxation

Q29: As the number of securities in a

Q42: A growth company can invest in projects

Q62: Quality financial statements are a good reflection

Q83: Stock prices move coincidentally with the economy.

Q89: Refer to Exhibit 4.5. Calculate the price

Q109: Refer to Exhibit 9.16. Calculate Rollerball Corporation's

Q117: Overall, the correlation coefficients of industries to