USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

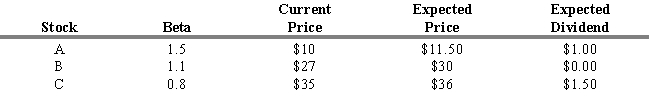

You expect the risk-free rate (RFR) to be 4 percent and the market return to be 10 percent. You also have the following information about three stocks.

-Refer to Exhibit 7.7. What are the estimated rates of return for the three stocks (in the order A, B, C) ?

Definitions:

Minangkabau Society

A matrilineal society in West Sumatra, Indonesia, characterized by female inheritance and property rights.

Matriarchal

A social system or family structure where the female, especially the mother, has the central role of authority and decision-making.

Economic

Relating to the production, consumption, and transfer of wealth within a society or country.

Social Power

The capacity or ability of individuals or groups to control or influence the actions, beliefs, or behaviors of others within a social context.

Q11: A contrary opinion technician would buy stock

Q32: A high-quality balance sheet typically has<br>A) limited

Q43: The value investor focuses on share price

Q62: There can be only one zero-beta portfolio.

Q66: The most common way to test a

Q77: Refer to Exhibit 4.2. What is the

Q82: In 2018, Montpelier Inc. issued a $100

Q111: The expectations hypothesis is also known as

Q125: The dividend payout ratio for the aggregate

Q207: Refer to Exhibit 9.1. What is your