USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

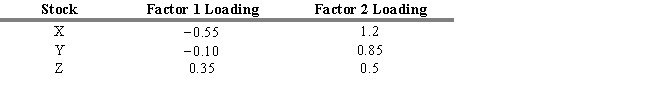

Consider the three stocks, stock X, stock Y, and stock Z, that have the following factor loadings (or factor betas) .

The zero-beta return ( 0) = 3 percent, and the risk premia are 1 = 10 percent and 2 = 8 percent. Assume that all three stocks are currently priced at $50.

The zero-beta return ( 0) = 3 percent, and the risk premia are 1 = 10 percent and 2 = 8 percent. Assume that all three stocks are currently priced at $50.

-Refer to Exhibit 7.9. If you know that the actual prices one year from now are stock X $55, stock Y $52, and stock Z $57, then

Definitions:

Base Compensation

The initial rate of pay provided to an employee, not including additional benefits, bonuses, or incentives.

Fringe Benefits Programs

Packages offered by employers outside of regular salaries, including health insurance, retirement plans, and other perks.

Organization

A group of individuals working together in a structured and coordinated fashion to achieve a set of goals.

Bonus Pay Plans

Compensation strategies that provide employees with additional financial rewards based on performance achievements, company profits, or other criteria warranting a bonus.

Q10: A company has a dividend payout ratio

Q15: Which of the fundamental factors was NOT

Q15: You are given a two-asset portfolio with

Q43: Which of the following is NOT a

Q68: Refer to Exhibit 5.5. What is the

Q76: In 2018, Venus Fly Co. issued a

Q98: An investor wishes to construct a portfolio

Q126: Results from studies on the effects of

Q139: A chart used to show only significant

Q150: Based on the daily closings for the