USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

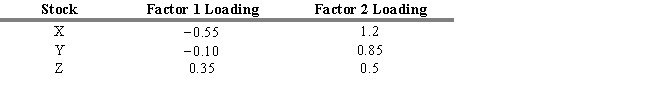

Consider the three stocks, stock X, stock Y, and stock Z, that have the following factor loadings (or factor betas) .

The zero-beta return ( 0) = 3 percent, and the risk premia are 1 = 10 percent and 2 = 8 percent. Assume that all three stocks are currently priced at $50.

The zero-beta return ( 0) = 3 percent, and the risk premia are 1 = 10 percent and 2 = 8 percent. Assume that all three stocks are currently priced at $50.

-Refer to Exhibit 7.9. Assume that you wish to create a portfolio with no net wealth invested. The portfolio that achieves this has 50 percent in stock X, -100 percent in stock Y, and 50 percent in stock Z. The weighted exposure to risk factor 1 for stocks X, Y, and Z are

Definitions:

Gross Investment

The total amount invested in the purchase of new capital assets plus replacement of depreciated assets, reflecting the total expenditure on new capital in an economy.

Depreciation

The process of allocating the cost of a tangible asset over its useful life, reflecting the decrease in value over time due to wear and tear or obsolescence.

Net Investment

The overall sum invested by a company or an economy in capital assets, with depreciation deducted.

Depreciation

Depreciation is an accounting method of allocating the cost of a tangible or physical asset over its useful life, representing how much of the asset's value has been used up.

Q6: If you have a portfolio with a

Q10: Which of the following is NOT a

Q11: The goal of the passive portfolio manager

Q12: Studies concerning quarterly earnings reports indicate that

Q26: Refer to Exhibit 7.1. Compute the intercept

Q31: There is little evidence from studies examining

Q59: Refer to Exhibit 9.9. What is the

Q72: Within a specific market, the top-down analyst

Q73: The growth rate of dividends and profit

Q83: Stock prices move coincidentally with the economy.