USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

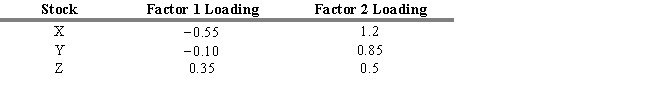

Consider the three stocks, stock X, stock Y, and stock Z, that have the following factor loadings (or factor betas) .

The zero-beta return ( 0) = 3 percent, and the risk premia are 1 = 10 percent and 2 = 8 percent. Assume that all three stocks are currently priced at $50.

The zero-beta return ( 0) = 3 percent, and the risk premia are 1 = 10 percent and 2 = 8 percent. Assume that all three stocks are currently priced at $50.

-Refer to Exhibit 7.9. The new prices now for stocks X, Y, and Z that will not allow for arbitrage profits are

Definitions:

Q1: Assume that as a portfolio manager the

Q4: You are provided with the following information

Q15: An investment bank can do an IPO

Q31: If the annual geometric mean for the

Q68: Which of the following is NOT a

Q77: An advantage of technical analysis over fundamental

Q100: Abnormal returns associated with rankings by a

Q105: A basic assumption of the Markowitz model

Q133: Issues that provide funds to retire another

Q210: A major advantage of the cyclical indicator