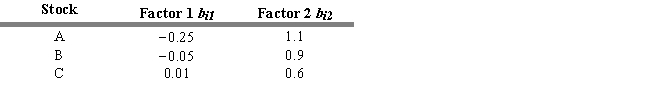

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Stocks A, B, and C have two risk factors with the following beta coefficients. The zero-beta return ( 0) = .025 and the risk premiums for the two factors are ( 1) = .12 and ( 0) = .10.

-Refer to Exhibit 7.10. Assume that stocks A, B, and C never pay dividends and stocks A, B, and C are currently trading at $10, $20, and $30, respectively. What is the expected price next year for each stock? A B C

Definitions:

Strabismus

A condition characterized by the improper alignment of the eyes, where they do not look towards the same direction at the same time.

Retina

The light-sensitive layer of tissue at the back of the inner eye, which sends visual signals to the brain.

Macula

A small, specialized central area of the retina responsible for sharp, detailed central vision.

Vitreous Humor

The clear, gel-like substance that fills the space between the lens and the retina in the eyeball, helping it maintain shape.

Q8: Refer to Exhibit 6.15. What is the

Q11: A contrary opinion technician would buy stock

Q28: An active portfolio manager sold $90 million

Q41: Refer to Exhibit 5.7. Calculate a 5-day

Q43: Refer to Exhibit 5.3. What is the

Q50: There are no composite series currently available

Q53: The expected return for Zbrite stock calculated

Q73: An investor constructs a portfolio with a

Q83: Stock prices move coincidentally with the economy.

Q91: Which of the following statements about the