USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

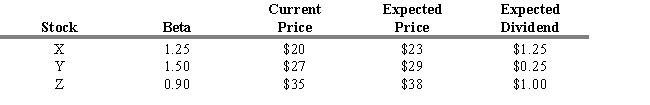

You expect the risk-free rate (RFR) to be 3 percent and the market return to be 8 percent. You also have the following information about three stocks.

-Refer to Exhibit 7.2. What are the expected (required) rates of return for the three stocks (in the order X, Y, Z) ?

Definitions:

Market Risk Premium

The additional return an investor requires for holding a risky market portfolio instead of risk-free assets, reflecting the extra risk.

Required Return

The minimum expected return by investors for investing in a particular asset, considering the risk associated with it.

Beta

It is a measure of a stock's volatility in relation to the overall market, indicating the stock's relative risk.

Risk-free Rate

The return on investment with no risk of financial loss, typically associated with government bonds.

Q10: The Morgan Stanley group index for Europe,

Q21: A growth investor focuses on the current

Q26: Refer to Exhibit 4.3. Calculate the average

Q29: Refer to Exhibit 4.5. Calculate the value

Q47: One of the economic series included in

Q57: Many analysts recommend that you should read

Q138: The Dow Theory contends that stock price

Q139: A chart used to show only significant

Q156: Refer to Exhibit 9.16. Calculate Rollerball Corporation's

Q206: Returns from the overall market (or an