USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

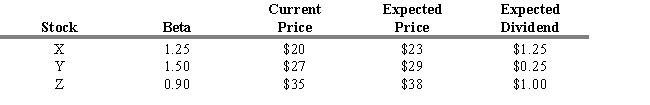

You expect the risk-free rate (RFR) to be 3 percent and the market return to be 8 percent. You also have the following information about three stocks.

-Refer to Exhibit 7.2. What are the estimated rates of return for the three stocks (in the order X, Y, Z) ?

Definitions:

Project Manager

An individual responsible for planning, executing, and closing projects, as well as leading the project team and ensuring project goals are met.

Kickoff Meetings

Initial meetings that mark the start of a project, where objectives, roles, and protocols are usually established.

Project Office

A centralized department that oversees and improves the management of projects within an organization, ensuring consistency and efficiency.

Policies And Procedures

Formalized rules and guidelines within an organization that outline operations, decision-making processes, and appropriate behavior for employees.

Q10: The Morgan Stanley group index for Europe,

Q24: An increase in debit balances means more

Q28: If there is a demand for more

Q38: Which of the following statements concerning active

Q46: The preliminary prospectus is often referred to

Q46: A block trade is one which involves

Q49: Using the constant growth model, an increase

Q59: Refer to Exhibit 6.2. What is

Q165: An examination of the relationship between stock

Q195: Which of the following statements concerning SWOT