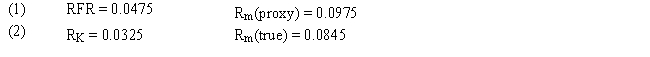

Assume that as a portfolio manager the beta of your portfolio is 0.85 and that your performance is exactly on target with the SML data under condition 1. If the true SML data is given by condition 2, how much does your performance differ from the true SML?

Definitions:

Competitors

Companies or individuals that engage in rivalry to offer goods or services in the same market, trying to achieve greater sales or market share.

Dominant Firm

Firm with a large share of total sales that sets price to maximize profits, taking into account the supply response of smaller firms.

Demand Curve

Illustrates the relationship between the price of a good or service and the quantity demanded by consumers, typically showing a downward slope.

Fringe Firms

Small companies that operate at the edges of a market, often providing alternative or innovative products compared to mainstream companies.

Q29: As the number of securities in a

Q31: In dividend discount models (DDM) with supernormal

Q34: The NYSE series should have higher rates

Q47: Style identification allows an investor to select

Q47: The weak-form efficient market hypothesis assumes all

Q86: Refer to Exhibit 3.7. Assume that you

Q95: According to the weak-form efficient market hypothesis,

Q133: Studies strongly suggest that the CAPM be

Q137: Refer to Exhibit 9.6. Calculate the per

Q160: If statistical tests of stock returns over