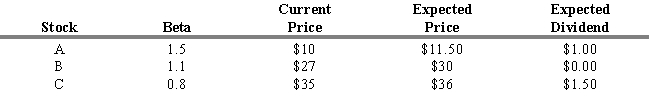

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

You expect the risk-free rate (RFR) to be 4 percent and the market return to be 10 percent. You also have the following information about three stocks.

-Refer to Exhibit 7.7. What are the estimated rates of return for the three stocks (in the order A, B, C) ?

Definitions:

Health Information

Data related to an individual's medical history, including diseases, treatments, and health conditions.

Evaluation Research

The process of determining whether a social intervention has produced the intended result (also known as program evaluation).

Social Programs

Government initiatives designed to provide public assistance in areas such as healthcare, education, and housing to improve the welfare of its citizens.

Ethical Violations

Actions or behaviors that breach established codes of conduct or standards of behavior expected in a specific profession or context.

Q3: The process of fundamental valuation requires estimates

Q7: 16.99%What is the expected return of the

Q18: What is the value of a 10

Q22: According to a study (Callahan and Mauboussin),

Q41: In the APT model, the identity of

Q82: In the case of a bond, the

Q83: Under the following conditions, what are the

Q129: Refer to Exhibit 9.13. Determine the P/E

Q143: Refer to Exhibit 7.5. Calculate the risk

Q154: Technical analysis and the efficient market hypothesis