USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

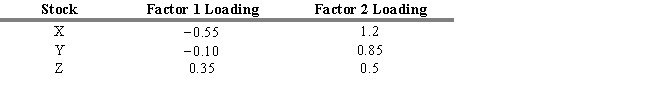

Consider the three stocks, stock X, stock Y, and stock Z, that have the following factor loadings (or factor betas) .

The zero-beta return ( 0) = 3 percent, and the risk premia are 1 = 10 percent and 2 = 8 percent. Assume that all three stocks are currently priced at $50.

The zero-beta return ( 0) = 3 percent, and the risk premia are 1 = 10 percent and 2 = 8 percent. Assume that all three stocks are currently priced at $50.

-Refer to Exhibit 7.9. The expected prices one year from now for stocks X, Y, and Z are

Definitions:

B2B

Business-to-Business, a model wherein transactions or trade happens directly between two businesses rather than between a business and individual consumer.

B2C

Business-to-Consumer, referring to the process of selling products and services directly to consumers who are the end-users.

C2B

Consumer to Business, a business model where consumers (individuals) create value or products that businesses purchase, consume or use, essentially reversing the traditional business-to-consumer (B2C) model.

C2C

Consumer-to-Consumer, a business model that facilitates the transaction of products or services between customers, typically using the internet.

Q13: A stock pitch is like a book

Q16: Refer to Exhibit 4.5. Calculate the unweighted

Q16: According to the segmented market hypothesis, yields

Q32: Refer to Exhibit 5.3. What is the

Q33: The fundamental determinants of interest rates are

Q51: Price-to-book value ratio cannot be used to

Q59: Refer to Exhibit 6.2. What is

Q112: All of the following factors affect the

Q141: The dividend payout ratio for the aggregate

Q160: It is reasonable to expect corporate sales