USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

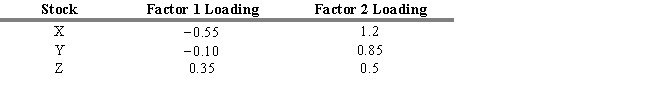

Consider the three stocks, stock X, stock Y, and stock Z, that have the following factor loadings (or factor betas) .

The zero-beta return ( 0) = 3 percent, and the risk premia are 1 = 10 percent and 2 = 8 percent. Assume that all three stocks are currently priced at $50.

The zero-beta return ( 0) = 3 percent, and the risk premia are 1 = 10 percent and 2 = 8 percent. Assume that all three stocks are currently priced at $50.

-Refer to Exhibit 7.9. If you know that the actual prices one year from now are stock X $55, stock Y $52, and stock Z $57, then

Definitions:

Irish-Americans

People in the United States who have full or partial ancestry from Ireland, contributing significantly to American culture and society.

Foreign Entanglements

Involvements or commitments by a country in international affairs, particularly in conflicts or alliances, which can complicate diplomatic relationships or lead to military action.

Porfirio Díaz

was a Mexican general and politician who served as President of Mexico for seven terms, overseeing a period of significant economic modernization and foreign investment, known as the Porfiriato.

Civil War

A significant internal conflict fought in the United States from 1861 to 1865 between the Northern states (Union) and the Southern states that seceded to form the Confederate States of America, primarily over issues of slavery and state sovereignty.

Q4: Fusion investing refers to the combination of<br>A)

Q10: The Morgan Stanley group index for Europe,

Q21: Operating margins are defined as<br>A) Gross Profit/Sales.<br>B)

Q22: According to a study (Callahan and Mauboussin),

Q33: Refer to Exhibit 7.4. Which of the

Q34: An undervalued stock is a growth stock.

Q63: A bond's price is determined by the

Q162: Which of the following is NOT an

Q170: Refer to Exhibit 9.4. What is the

Q199: The expected rate of return on Research