USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

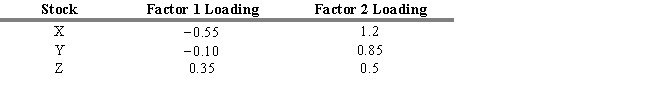

Consider the three stocks, stock X, stock Y, and stock Z, that have the following factor loadings (or factor betas) .

The zero-beta return ( 0) = 3 percent, and the risk premia are 1 = 10 percent and 2 = 8 percent. Assume that all three stocks are currently priced at $50.

The zero-beta return ( 0) = 3 percent, and the risk premia are 1 = 10 percent and 2 = 8 percent. Assume that all three stocks are currently priced at $50.

-Refer to Exhibit 7.9. Assume that you wish to create a portfolio with no net wealth invested. The portfolio that achieves this has 50 percent in stock X, -100 percent in stock Y, and 50 percent in stock Z. The weighted exposure to risk factor 1 for stocks X, Y, and Z are

Definitions:

Theoretical Orientation

A conceptual framework that guides a practitioner's approach to understanding clients and addressing their psychological concerns.

Assessment Process

A systematic procedure for collecting, analyzing, and interpreting information to evaluate individuals, groups, or programs.

DSM-I

The first edition of the Diagnostic and Statistical Manual of Mental Disorders, published by the American Psychiatric Association.

20th Century

A historical era spanning from the year 1901 to 2000, noted for significant developments in technology, politics, and culture.

Q1: Which of the following is NOT a

Q8: An analysis of U.S. equity markets using

Q9: There is a direct relationship between a

Q21: Refer to Exhibit 9.15. Calculate the adjusted

Q27: Treasury Inflation-Protected Securities (TIPS) are inflation-indexed bonds

Q34: An undervalued stock is a growth stock.

Q35: The Ryan Treasury Index is an example

Q69: Even when fees and costs are considered,

Q71: Refer to Exhibit 6.11. Calculate the expected

Q200: Refer to Exhibit 9.16. Calculate the sustainable