USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

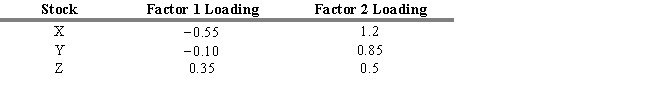

Consider the three stocks, stock X, stock Y, and stock Z, that have the following factor loadings (or factor betas) .

The zero-beta return ( 0) = 3 percent, and the risk premia are 1 = 10 percent and 2 = 8 percent. Assume that all three stocks are currently priced at $50.

The zero-beta return ( 0) = 3 percent, and the risk premia are 1 = 10 percent and 2 = 8 percent. Assume that all three stocks are currently priced at $50.

-Refer to Exhibit 7.9. The new prices now for stocks X, Y, and Z that will not allow for arbitrage profits are

Definitions:

Fire Screens

Protective barriers placed in front of fireplaces to prevent sparks from escaping into the room.

FIFO Method

A method of inventory valuation where the first items placed in inventory are the first ones sold, standing for First-In, First-Out.

Ending Inventory

The total value of all goods available for sale at the end of an accounting period.

Spark Plugs

An engine component that ignites the fuel-air mixture in the combustion chamber of gasoline engines.

Q9: Using the S&P index as the proxy

Q10: In returns-based style analysis, a coefficient of

Q16: Refer to Exhibit 4.5. Calculate the unweighted

Q29: Refer to Exhibit 4.5. Calculate the value

Q46: In most countries, sovereign bond issues are

Q56: A growth company is one that has

Q58: A growing percentage of institutional investors are

Q60: In _ strategy, certain economic sectors or

Q65: Ross Corporation paid dividends per share of

Q159: To benefit from cost leadership, a firm