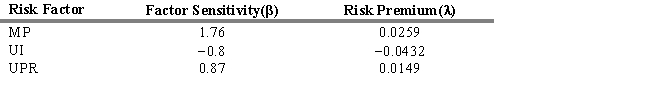

The table below provides factor risk sensitivities and factor risk premia for a three-factor model for a particular asset, where factor 1 is MP (the growth rate in U.S. industrial production) , factor 2 is UI (the difference between actual and expected inflation) , and factor 3 is UPR (the unanticipated change in bond credit spread) .  Calculate the expected excess return for the asset.

Calculate the expected excess return for the asset.

Definitions:

BE

An acronym that could stand for various terms depending on context, such as "Base Excess" in blood gas analysis, indicating the excess or deficit in the amount of base in the blood.

X-Ray Images

Pictures obtained by using X-ray technology to visualize the internal structures of the body, aiding in medical diagnosis.

Screen Monitor

An electronic output device that displays information in pictorial form, usually used with computers.

Projecting

The act of extending outwards or forwards or the act of estimating or forecasting something based on current trends or data.

Q3: Refer to Exhibit 4.2. Calculate a value

Q17: Completeness funds are portfolios designed to complement

Q33: A divergence between an increase in a

Q37: The importance of an industry's performance on

Q41: Refer to Exhibit 5.7. Calculate a 5-day

Q45: The planning period for the CAPM is

Q47: The expected return for a stock, calculated

Q57: In Berkshire Hathaway annual reports, Warren Buffet

Q96: Refer to Exhibit 5.7. Calculate a four-day

Q129: Refer to Exhibit 5.2. What is the