USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

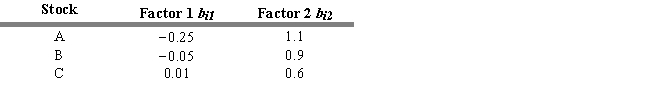

Stocks A, B, and C have two risk factors with the following beta coefficients. The zero-beta return ( 0) = .025 and the risk premiums for the two factors are ( 1) = .12 and ( 0) = .10.

-Refer to Exhibit 7.10. Assume that stocks A, B, and C never pay dividends and stocks A, B, and C are currently trading at $10, $20, and $30, respectively. What is the expected price next year for each stock? A B C

Definitions:

Antitrust Law

Legislation aimed at preventing monopolies and promoting competition to protect consumers from unfair business practices.

Monopoly Power

is the ability of a single company or entity to control a significant portion of the market for a particular product or service, limiting competition.

Antitrust Laws

Regulations designed to protect trade and commerce from unfair practices, such as monopolies and cartels.

Cartel

An association of independent businesses organized to control production, pricing, and marketing of goods to minimize competition.

Q2: Refer to Exhibit 6B.1. Show the

Q23: Fama and French suggest a four-factor model

Q25: A bond's maturity is affected by call

Q49: Refer to Exhibit 7.3. The average return

Q58: Instruments for intermediate-term issues with maturities in

Q75: Behavioral finance considers how various psychological traits

Q78: The separation theorem divides decisions on _

Q81: Results of initial public offering (IPOs) studies

Q91: One of the potential disadvantages of technical

Q142: Technicians using the confidence index published by