USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

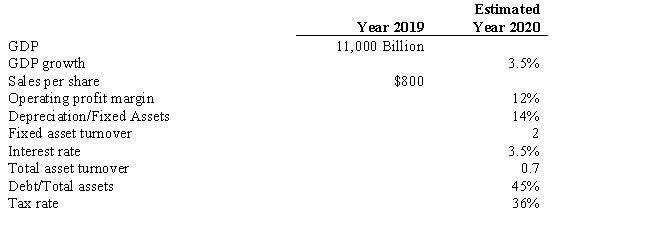

Consider the following information that you propose to use to obtain an estimate of year 2004 EPS for the MacLog Company.

In addition, a regression analysis indicates the following relationship between growth in sales per share for MacLog, and GDP growth is

In addition, a regression analysis indicates the following relationship between growth in sales per share for MacLog, and GDP growth is

% Sales per share = 0.015 + 0.75(% GDP)

-Refer to Exhibit 9.6. Estimate the firm's sales per share for the year 2020.

Definitions:

High Leverage

Refers to the use of significant amounts of borrowed money (debt) to increase the potential return of an investment.

Interest Obligations

The amount of interest that a borrower is contractually obligated to pay to lenders over a specified period of time.

Equity Capital

Funds that are invested in a company by its shareholders in exchange for ownership rights or shares, representing the risk capital of the business.

New Stocks

Shares that have been recently issued to the public by a company, often through an initial public offering (IPO).

Q17: The sell-side refers to firms that facilitate

Q18: Assume that you purchase a three-year, $1,000

Q27: Treasury Inflation-Protected Securities (TIPS) are inflation-indexed bonds

Q43: The correlation coefficient and the covariance are

Q55: When identifying undervalued and overvalued assets, which

Q65: Samurai bonds are yen-denominated bonds sold in

Q82: In the case of a bond, the

Q83: Revenue bonds are essentially backed by the

Q164: Refer to Exhibit 9.1. To what price

Q170: Refer to Exhibit 9.4. What is the