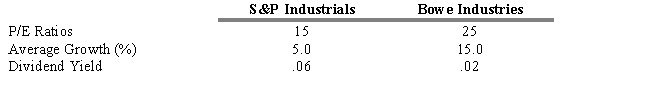

What is the implied growth duration of Bowe Industries given the following:

Definitions:

Weighted Average Cost of Capital (WACC)

The average rate of return a company is expected to pay its securities holders, weighted by the proportion each financing source contributes to the total capital structure.

Corporate Tax Rates

The percentage of corporate profits taken as tax by the government.

After-Tax Cost

The net cost of an investment or transaction after considering the effects of taxes on its overall expenses or returns.

WACC

Weighted Average Cost of Capital, a calculation of a firm’s cost of capital in which each category of capital is proportionately weighted.

Q5: You purchase a 10 3/8s February $10,000

Q9: A growth company may exist for all

Q39: Calculate the modified duration of a bond

Q51: An investor in a pure yield pickup

Q52: The overallotment option gives the investment bank

Q58: The value of a call option just

Q68: Credit analysis and core-plus management are examples

Q69: Dividend growth is positively related to the

Q73: Refer to Exhibit 13.13. Assume that your

Q124: Collateralized mortgage obligations (CMOs) offset some of