USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

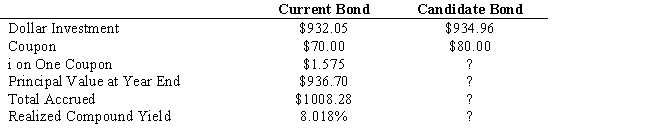

The following information is given concerning a pure yield pick-up swap: You currently hold a 10-year, 7 percent coupon bond priced to yield 8 percent. As a swap candidate, you are considering a 10-year, 8 percent coupon bond priced to yield 9 percent. Assume a reinvestment at 9 percent, semiannual compounding, and a one-year workout period.

-Refer to Exhibit 13.4. The realized compound yield on the candidate bond is

Definitions:

Economic Usefulness

The degree to which a product or service can satisfy consumers' needs and desires, thus determining its value in the market.

Peyton Manning

A retired American football quarterback who played in the National Football League (NFL), known for his records and time with the Indianapolis Colts and Denver Broncos.

Arthritis Medication

Medicines used to treat inflammation, pain, and stiffness associated with arthritis.

Long-Run Equilibrium

A situation in competitive markets where all firms are making normal profits, and there is no incentive for market entry or exit.

Q47: The Chicago Board of Trade (CBT) uses

Q53: Corporations can use many tools in order

Q61: There are a number of differences between

Q61: Refer to Exhibit 15.7. What will the

Q67: Like hedging, arbitrage results in increased returns

Q81: Suppose you have a 10 percent, 20-year

Q92: General obligation bonds (GOs) are serviced by

Q171: Which of the following is NOT considered

Q186: Given Gitech's beta of 1.55 and a

Q209: _ tend to move in anticipation of