USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

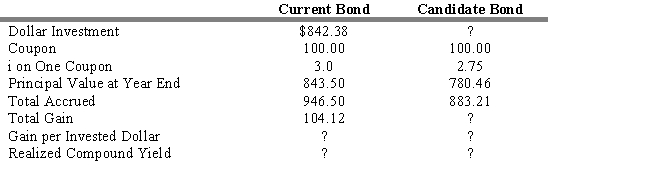

The following information is given concerning a substitution swap. You currently hold a 25-year, Aa 10-percent coupon bond priced to yield 12 percent. As a swap candidate, you are considering a 25-year, Aa 10 percent coupon bond priced to yield 13 percent. Assume a reinvestment rate of 12 percent, semiannual compounding, and a one-year workout period.

-Refer to Exhibit 13.9. The dollar investment in the candidate bond is

Definitions:

Elasticity Measures

refer to the quantitative analysis of changes in economic variables in response to changes in other variables, such as price or income.

Income Elasticity

A measure of how the demand for a good changes in response to a change in consumers' income.

Confederate Currency

The currency issued by the Confederate States of America during the American Civil War, now considered a collectible item.

Market Price

The prevailing rate at which a good or service is available for purchase or sale in the public market.

Q12: The underlying stock price and the value

Q16: According to the segmented market hypothesis, yields

Q46: An advantage of quadratic programming is that

Q49: Refer to Exhibit 15.13. Assume that a

Q61: There are a number of differences between

Q76: A firm has a current price of

Q86: There is an inverse relationship between the

Q93: Assume that you purchased shares of a

Q124: Refer to Exhibit 15.5. Assume that a

Q148: Refer to Exhibit 15.18. Suppose that three-month