USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

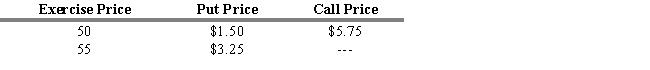

The current stock price of ABC Corporation is $53.50. ABC Corporation has the following put and call option prices that expire six months from today. The risk-free rate of return is 5 percent, and the expected return on the market is 11 percent.

-Refer to Exhibit 14.4. What should the price be of a call option that expires six months from today with an exercise price of $55?

Definitions:

Stockholders

Individuals or entities that own shares of stock in a corporation, thereby having a residual claim on the company's assets and earnings.

Solvency

This financial term refers to an entity's ability to meet its long-term financial obligations, indicating financial stability.

Interest Payments

Payments made to lenders as compensation for borrowing money, typically calculated as a percentage of the principal.

Debt

An amount of money borrowed by one party from another, often used to make large purchases that are not affordable with available cash.

Q22: Treynor's performance measure implicitly assumes a completely

Q30: A company is going public with an

Q42: Refer to Exhibit 15.10. Assume that a

Q50: Refer to Exhibit 15.15. Assuming that three-month

Q55: Capital allocation is the description of how

Q59: At what point would an investor be

Q94: Refer to Exhibit 13.9. The value of

Q101: Relative return portfolio performance measures<br>A) adjust portfolio

Q143: Refer to Exhibit 15.8. If the futures

Q168: Refer to Exhibit 9.16. Calculate Rollerball Corporation's