USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

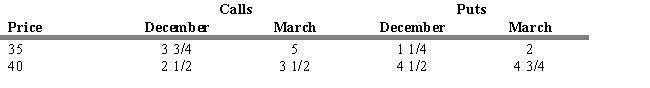

On the last day of October, Bruce Springsteen is considering the purchase of 100 shares of Olivia Corporation common stock selling at $37 1/2 per share and is considering an Olivia option.

-Refer to Exhibit 14.1. If Bruce decides to buy a March call option with an exercise price of 35, what is his dollar gain (loss) if he closes his position when the stock is selling at 43 1/2?

Definitions:

Canadian Medical Association

A national, voluntary association of physicians that advocates on behalf of its members and the public for access to high-quality health care, and provides leadership and guidance to physicians.

Multinational Corporation

A large company that operates and provides goods or services in multiple countries beyond its original country of establishment, often exercising significant economic and political influence globally.

Branch Plant

A factory or office operated in a country by a foreign company, often perceived as a subordinate extension of its parent company.

Collateral Labour Markets

Secondary or peripheral segments of the labour market characterized by lower job security, lower wages, and less formal employment structures.

Q4: Consider a 10 percent, 15-year bond that

Q14: Investors want directors who will voice their

Q41: An option buyer must exercise the option

Q41: For a bond investor selecting a buy-and-hold

Q53: Growth stocks would have the following characteristics:<br>A)

Q71: Like future contracts, all forward contracts are

Q78: Of the following provisions that may be

Q87: When a borrower pledges financial assets as

Q91: Calculate the yield to maturity of a

Q107: Interest rate anticipation is the most conservative