USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

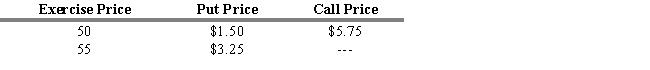

The current stock price of ABC Corporation is $53.50. ABC Corporation has the following put and call option prices that expire six months from today. The risk-free rate of return is 5 percent, and the expected return on the market is 11 percent.

-Refer to Exhibit 14.4. What should the price be of a call option that expires six months from today with an exercise price of $55?

Definitions:

Variable Costs

Outlays that shift directly in line with the magnitude of output or production.

Production

The creation of goods and services using labor, technology, and inputs of raw materials to meet consumer demand.

Fixed Costs

Fixed costs that are unaffected by the amount of goods produced or sold, like rent, wages, and insurance charges.

Rent

A periodic payment made for the use of land, a building, or other property.

Q10: In returns-based style analysis, a coefficient of

Q17: A function your portfolio manager may perform

Q34: Which of the following is NOT a

Q42: A one-year call option has a strike

Q43: The value investor focuses on share price

Q54: $100,000.00.On January 2, 2017, you invest $100,000

Q73: Refer to Exhibit 13.13. Assume that your

Q82: Refer to Exhibit 16.4. A short straddle

Q122: The futures exchange requires each customer to

Q127: Assume the exchange rate is GBP 1.35/USD,