USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

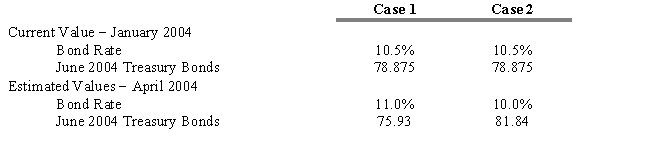

In late January 2004, The Union Cosmos Company is considering the sale of $100 million in 10-year bonds that will probably be rated AAA like the firm's other bond issues. The firm is anxious to proceed at today's rate of 10.5 percent. As treasurer, you know that it will take until sometime in April to get the issue registered and sold. Therefore, you suggest that the firm hedge the pending issue using Treasury bond futures contracts each representing $100,000.

-Refer to Exhibit 15.1. What is the dollar gain or loss assuming that future conditions described in Case 1 actually occur? (Ignore commissions and margin costs.)

Definitions:

Sexual Energy

The energy associated with sexual desires and activities.

Repressed Memories

Experiences that are unconsciously set aside because they carry a high emotional burden of stress or trauma.

Aggressive Tendencies

Traits or behaviors characterized by aggression, where individuals may exhibit hostile or violent attitudes and actions towards others.

Repression

A defense mechanism in psychoanalytic theory where distressing thoughts and feelings are unconsciously pushed out of conscious awareness.

Q22: Refer to Exhibit 16.9. At present, what

Q31: Which of the following are functions that

Q38: Bailey, Richards, and Tierney maintain that any

Q46: Refer to Exhibit 13.3. Calculate the Macaulay

Q52: The Jensen measure requires that each period's

Q60: Refer to Exhibit 24.1. What is the

Q76: Holding a put option and the underlying

Q84: The CFA Institute encourages managers to disclose

Q92: Attribution analysis separates a portfolio manager's performance

Q93: The conversion premium for a convertible bond