USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

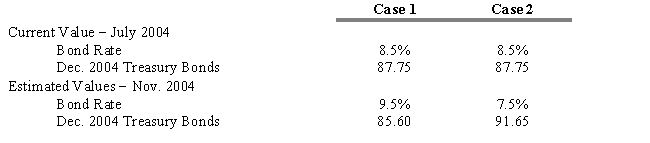

Assume you are the Treasurer for the Johnson Pharmaceutical Company and in late July 2004, the company is considering the sale of $500 million in 20-year bonds that will most likely be rated the same as the firm's other debt issues. The firm would like to proceed at the current rate of 8.5%, but you know that it will probably take until November to bring the issue to market. Therefore, you suggest that the firm hedge the pending issue using Treasury bond futures contracts, which each represent $100,000.

-Refer to Exhibit 15.2. How you would go about hedging the bond issue?

Definitions:

Irrational Behavior

Actions or decisions that do not logically follow from a rational analysis of the situation.

Misperception

A misunderstanding or incorrect interpretation of a situation, often leading to erroneous decisions or beliefs.

Opportunity Costs

The price paid for not choosing the second-best option available when deciding.

Risk Aversion

A preference for avoiding loss over making a gain, indicating a greater sensitivity to losses than to equivalent gains.

Q11: Refer to Exhibit 13.12. Assume that your

Q30: The conversion parity price is equal to

Q42: Refer to Exhibit 15.10. Assume that a

Q48: Refer to Exhibit 16.1. If the spot

Q50: Refer to Exhibit 15.15. Assuming that three-month

Q55: Refer to Exhibit 13.10. Calculate the percentage

Q60: Refer to Exhibit 24.1. What is the

Q76: Suppose the current seven-year rate is 8

Q77: While LIBOR is usually used with forward

Q102: When securities are held in an investment