USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

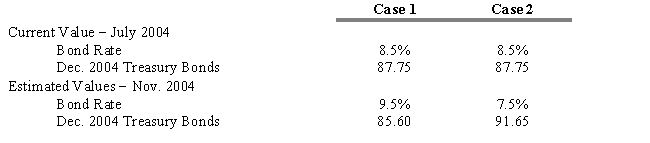

Assume you are the Treasurer for the Johnson Pharmaceutical Company and in late July 2004, the company is considering the sale of $500 million in 20-year bonds that will most likely be rated the same as the firm's other debt issues. The firm would like to proceed at the current rate of 8.5%, but you know that it will probably take until November to bring the issue to market. Therefore, you suggest that the firm hedge the pending issue using Treasury bond futures contracts, which each represent $100,000.

-Refer to Exhibit 15.2. What is the dollar gain or loss assuming that future conditions described in Case 2 actually occur? (Ignore commissions and margin costs .)

Definitions:

Absorption Costing

A method of product costing that incorporates all manufacturing costs, including both fixed and variable costs, in the price of a product.

Variable Costing

An accounting method that charges only variable costs to cost of goods sold and reports fixed costs separately as period costs.

Fixed Manufacturing Overhead

Costs associated with production that do not vary with the level of output, such as salaries of managers and rent for factory buildings.

Absorption Costing

An accounting method that includes all manufacturing costs—direct materials, direct labor, and both variable and fixed overhead—in the cost of a product.

Q7: Free trade refers to trade between countries<br>A)that

Q26: Refer to Exhibit 16.8. If you establish

Q26: All of the following are sources of

Q32: There are four major factors accounting for

Q45: Refer to Exhibit 13.8. The value of

Q49: Refer to Exhibit 15.13. Assume that a

Q71: Refer to Exhibit 13.5. The realized compound

Q83: Refer to Exhibit 16.6. What would the

Q89: Indexing is an active portfolio management strategy

Q126: Which type of bond is backed by