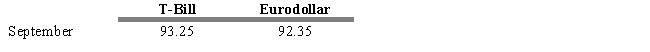

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Assume that you observe the following prices in the T-Bill and Eurodollar futures markets

-Refer to Exhibit 15.5. Assume that a month later the price of the September T-Bill future is 93 and the price of the Eurodollar future is 90.25. Calculate the profit on the T-Bill futures position.

Definitions:

Hard Erection

The state of having a rigid penile erection, typically indicating sexual arousal in males.

Temporary Restraints

Short-term use of physical or mechanical devices to prevent patients from harming themselves or others.

Home Medications

Medications that a patient has been prescribed and is taking as part of their ongoing outpatient treatment regimen.

Alzheimer's Disease

A progressive neurological disorder characterized by memory loss, cognitive decline, and personality changes, leading to severe dementia.

Q35: An expiration date payoff and profit diagram

Q44: A call option in which the stock

Q51: Which type of bond market is the

Q53: A tariff<br>A)makes domestic consumers better off.<br>B)makes both

Q59: Modified duration is determined by making small

Q65: Samurai bonds are yen-denominated bonds sold in

Q88: In the Black-Scholes option pricing model, an

Q113: Which of the following is NOT a

Q116: A bond that only pays a principal

Q117: Forward contracts are individually designed agreements and